Opinion: A budget proposal tells you how the GOP rates crime, cops Los Angeles Times

Table Of Content

Average house prices dropped by 1.2% in the year to October, according to the latest government figures published by the Office for National Statistics (ONS). Cash purchases accounted for around a third of all property sales in 2023, according to Zoopla. The average price of a cash purchase is 10% lower than the average mortgage-funded sale. This makes cash purchases slightly more affordable and likely to require more modest price reductions to attract demand. The rent on newly-let properties rose by more than 10% in the year to November (an average jump of £125 on annual rent in real terms), according to estate agent Hamptons.

Dollars and Pets: Boarding and house sitting costs for pets - The Mercury News

Dollars and Pets: Boarding and house sitting costs for pets.

Posted: Tue, 05 Dec 2017 08:00:00 GMT [source]

April: Headline Figures Masks Regional Variations

In contrast, price growth over the past 12 months to February was slowest in London, which recorded a figure of 3.2%. Average house price growth slowed in the year to April to 12.1%, from 14.3% recorded in March. At a regional level Wales, with a figure of 15.3%, recorded the strongest annual house price growth to June. Next came the South West of England (12.9%), followed by the East Midlands (12.5%), and the West Midlands (11.5%). In terms of regional variations, England experienced an annual increase of 11.9% compared to 16.2% for both Wales and Scotland. However, average house prices remain higher in England at £299,249 compared to £211,990 in Wales and £187,954 in Scotland.

November: Relief for borrowers as Bank rate stays at 0.1% – for now

This is because of the expectation that the landlord will not charge a realistic amount of rent or will be more forgiving on any non-payments. Additionally, the interest charged may be higher than for normal residential mortgages because of the risks involved. He added that the ‘full house’ is an ‘extremely rare’ event, seen for the last time since March 2007. The provisional number of residential property transactions (seasonally adjusted) in October 2021 stood at 76,930, which is a staggering 52% less than September, and 28.2% lower than October last year.

October: Rightmove – Asking Prices Up But Growth Set To Slow

Average house prices grew by 10.3% in the year to November 2022, down from October’s figure of 12.4%, according to data from the Office for National Statistics and the Land Registry, writes Jo Thornhill. Halifax, Britain’s biggest mortgage lender, says stability returned to the UK housing market in January after falls in the value of a typical property in the closing months of 2022. There was also a mixed picture for house prices at a regional level around the UK. Halifax notes that prices for flats have fallen by 0.3% over the past 12 months, while prices for terraced properties have edged up by 0.3%. Figures from Halifax, the UK’s biggest mortgage lender, show property prices rising 2.1% in the year to February, and 1.1% month on month. However, the Office for Budget Responsibility is forecasting that inflation will fall to 2.9% by the end of the year – sooner than previously forecast.

Demand remains 33% lower than 12 months ago, and is in line with figures seen in 2019. The number of new sales agreed has also increased and is closely tracking 2019 levels, although sales figures are 19% down on the five-year average. “That said, recent figures for mortgage approvals suggest a slight uptick in activity levels, which is likely as a result of an improving picture on affordability for homebuyers. With mortgage rates starting to ease slightly, this may be leading to increased buyer confidence, seeing people more inclined to push ahead with their home purchases. But annual house prices have fallen across the capital by an average of 1.1%, and the average property price now stands at £536,800.

Rest easy knowing your home is in good hands with house sitters

"And that's why I've already had discussions in The Hague (including with EU law enforcement agency Europol) about how quickly we can share data intelligence to do that," he said. "Obviously I am a very popular figure in this country so hopefully by me getting involved in politics, I can maybe make a difference to ordinary people." Guto Harri, the former Number 10 director of communications under Boris Johnson, has said it is a "realistic prospect" the Conservatives could move against Rishi Sunak if the results of the local elections are bad. A former Number 10 director of communications thinks Tory MPs could move against the prime minister if the local elections go particularly badly.

Asking prices rose on average by 0.6% in London this month (they are up 0.9% year on year), showing a tentative return of confidence for the capital. In Wales prices rose 0.3% in March (£256,499) and are the same (0% rise) annually. This has stalled the decline in mortgage rates that had helped to drive market activity around the turn of the year. The average asking price of newly-marketed properties rose by 1.1% in April, more than £4,200 in cash terms, according to online property site Rightmove, writes Jo Thornhill. Prices in Wales have risen a more modest 0.7% during the same period (average price now £204,300). But prices are up 4.4% in Northern Ireland, where the average property is now worth £168,400.

Despite these factors, it has been a positive start to the year in comparison to the more muted start to 2023. There is a regional north-south divide in England when it comes to annual house price inflation. Around the regions, average property prices in the West Midlands performed best by bucking December’s decline and recording a rise of 1.6% during the month. Annual house price inflation stood at 9.8% in December, its highest level for 14 years.

February: Bank Of England Raises Rate To 0.5%

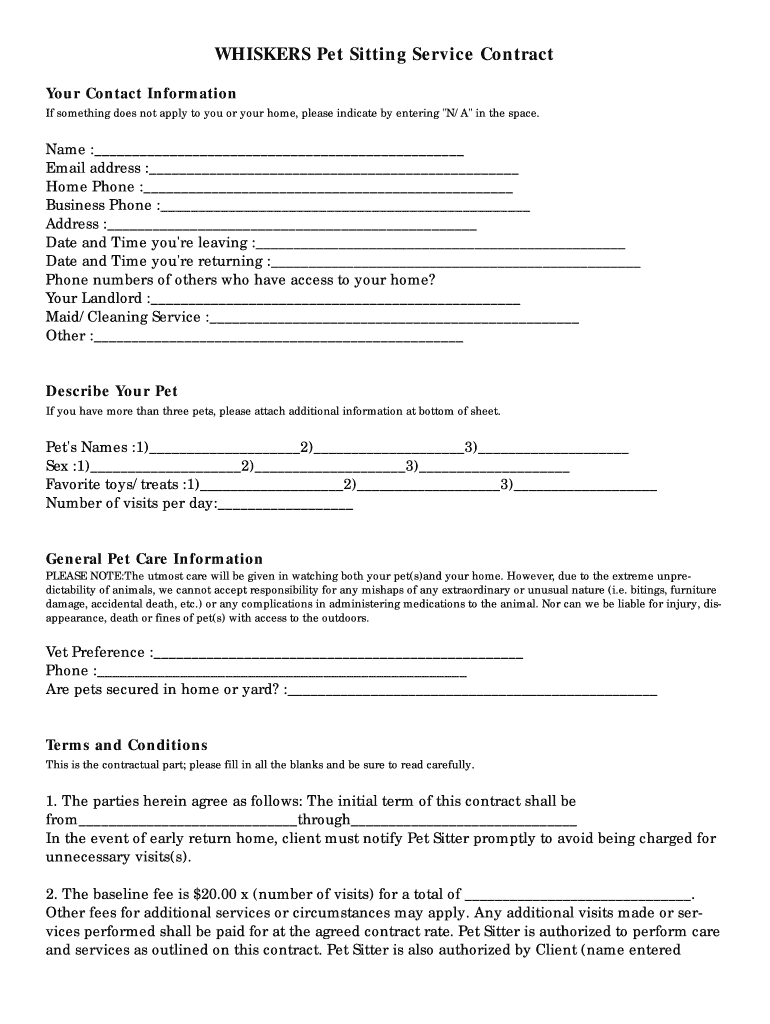

These could include transportation costs if the sitter needs to commute to your home, expenses for purchasing pet food or supplies, and reimbursement for other agreed-upon expenses. It's essential to communicate openly with potential house sitters about any additional costs to avoid misunderstandings and ensure a fair agreement for both parties. According to the house sitters we spoke with, and available data, the general range is wide. Rightmove said this was the largest increase recorded at this time of year since 2007. The firm said a record figure had been achieved in each of the past four months. The average property price is now £21,389 (6.7%) higher than at the start of 2021.

Mortgage applications in London now account for 14% of all mortgage applications, a level last seen in December 2019. Online mortgage broker, Trussle, calculated that the latest rate rise could add a further £331.56 to the average mortgage annually for customers whose home loans are based on standard variable rates. This is on the back of an already-soaring UK inflation rate which, as measured by the Consumer Prices Index, jumped to 5.5% in the 12 months to January 2022 – its highest level in 30 years. London, which has been lagging behind the rest of the UK in terms of price rises, recorded the biggest jump in buyer enquiries at 24% higher than last February. “Alongside the overall increase on household bills, the past week has seen petrol and diesel prices rise significantly – something that may hit those saving for potential house deposits. The figure currently stands at 0.5% with the prospect of another rise in the pipeline, perhaps as soon as this month (the next bank rate decision is due on 17 March).

Meanwhile, a new report from think-tank the National Institute of Economic and Social Research (NIESR) predicts the number of mortgage holders in negative equity will rise significantly by 2025. It says the number of homeowner mortgages in arrears in the third quarter of the year was 7% higher than in the previous quarter. Property values are falling across all areas of England and Wales, with the biggest falls in the Eastern region where they are down by 2.6%, followed by the South East(down by 2.4%) and London, down by 2.0%. It follows a year where total gross lending fell by more than one quarter (28%) with a 23% fall in lending for residential home purchase and buy-to-let purchase lending was down by more than half (52%). Rightmove says that the more stable market conditions should see family movers return to the market after putting their plans on hold due to economic uncertainty last year.

As part of last week’s mini-budget, Kwasi Kwarteng, the Chancellor of the Exchequer, announced an extension from £125,000 to £250,000 for the Stamp Duty nil-rate band as applied to properties in England and Northern Ireland. Profits for the year to date stand at £4 billion after tax, down from £5.4 billion after tax for the first nine months of 2021. The numbers of people looking for properties to rent rather than buy are up sharply, according to new research. Since the beginning of November almost £7,000 has been wiped off the value of a typical UK property, which now stands at £285,579. The slowdown has hit demand in parts of southern England, including east Kent, Portsmouth and Torquay, along with the Lake District and mid-Wales.

Comments

Post a Comment